Statistics show that within seven years of coming into money, the average person will be living at the same economic level as before the windfall appeared. The explanation for this typically lies in a person’s “money scripts”, the powerful beliefs they formed about money, usually in childhood. These money scripts tend to remain unconscious and tend to be “generational” in that they frequently get passed down from parent to child.

Money scripts can be difficult to spot because they’ll often feel “true” to the person and, in certain circumstances, may even be true. However, if they remain unquestioned, they mean we repeat patterns that deprive us of prosperity and peace of mind.

To give you an idea of what money scripts look like, here are some common ones:

WORKAHOLICS

Once you have enough money, then you’ll be able to relax and enjoy life

You must work hard for money

The more money you have, the happier and safer you will be

Your worth is determined by how much money you make

THOSE WHO HAVE MONEY

You can’t trust anyone with your money

People only want you for your money

You didn’t work for this money, so you don’t deserve it

You mustn’t lose, or make a mistake with, the money you’ve got

THOSE WHO DON’T HAVE MONEY

This isn’t enough money – so there’s no point in trying to save

You’re not worth more (so stay in the job you hate)

Money is bad / evil / unimportant

Rich people got that way by taking advantage of others

You deserve to treat yourself so spending beyond your means is okay

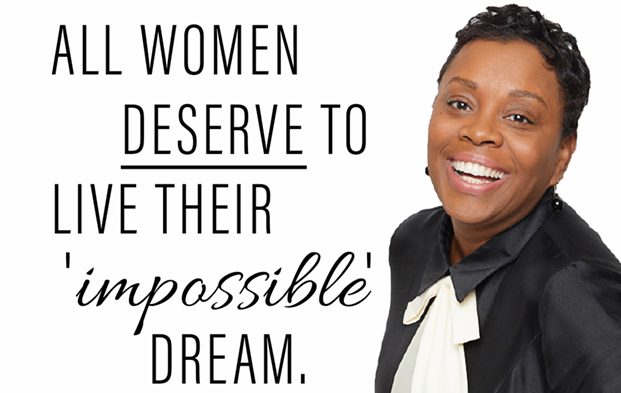

WOMEN

Husbands take care of money so wives don’t have to

Making money is difficult / overwhelming / impossible

You’ll never be able to earn enough, so you need a man with money

MONEY IN RELATIONSHIPS

Understanding what messages you received about money in your childhood is the first step to learning how to communicate with others about money. If you don’t understand your own history and “childhood tapes”, then conversations about money (with spouses, friends, family members, bosses) are unlikely to be as easy and straightforward as they could be.

Statistics suggest that 70% of marital breakdowns are due to money problems. Of course the arguments aren’t actually about the money per se – these disputes happen whether funds are tight or plentiful. What couples are really arguing about is their own attitude to money, and what it represents. Is money for spending and giving away? Is money for safety and security? Does money equal power in a relationship? Does money equal love? Is it acceptable for a wife to earn more than her husband? Does one have to share everything or is it okay to have secret funds (or secret debts) that your partner doesn’t know about?

All sorts of relationship dynamics can get unleashed around money which can represent so many things – power, control, safety, security, status, worth, love. According to research from the American Sociological Association, the more economically dependent a man is on his female partner, the more likely he is to cheat on her. Whilst for women, economic dependency seems to have the opposite effect.

Life changes that shift income – a promotion, a redundancy, giving up work to look after children – also typically shift the power balance in a relationship. When one member of the couple earns less, they may feel they have to take on the role of “pleaser” in the relationship, to make up for not bringing as much to the table. Equally, if the poorer partner feels beholden to the richer one, they’re likely to drop into victimhood or resentment (or both) especially if they’re having to ask for money which can feel humiliating and disempowering.